4.3 Recoupment of Incorrect Benefits

Occasionally CTS benefits are overpaid. This may happen when an SSI parent was ineligible for CTS because their child(ren) was out of the home, the child received SSI for the month in question, the parent’s SSI eligibility was retroactively denied by the Social Security Administration, or the parent provided fraudulent information that led to CTS eligibility. In addition, if benefits are continued pending a fair hearing and the agency's adverse action is upheld, or the fair hearing is withdrawn or abandoned, any overpayments caused by benefits having been continued may be subject to recovery. Both member and agency errors are subject to recovery as long as they meet the requirements provided below.

Since CTS benefits are paid as part of the parent’s SSI benefit payment, the State SSI program recoups overpaid benefits. While CARES and BRITS do not track CTS benefit recovery, the local agency worker determines when an overpayment has occurred (see Process Help, Section 9.9.9 Overpayments).

Administrative Rules (DHS 2) permit the State SSI program to collect 10% of each future SSI payment (which may include CTS benefits) until an overpayment is repaid. SSI parents may repay the entire amount owed in a single payment or negotiate with the State SSI program for a payment schedule that is higher than 10% per month.

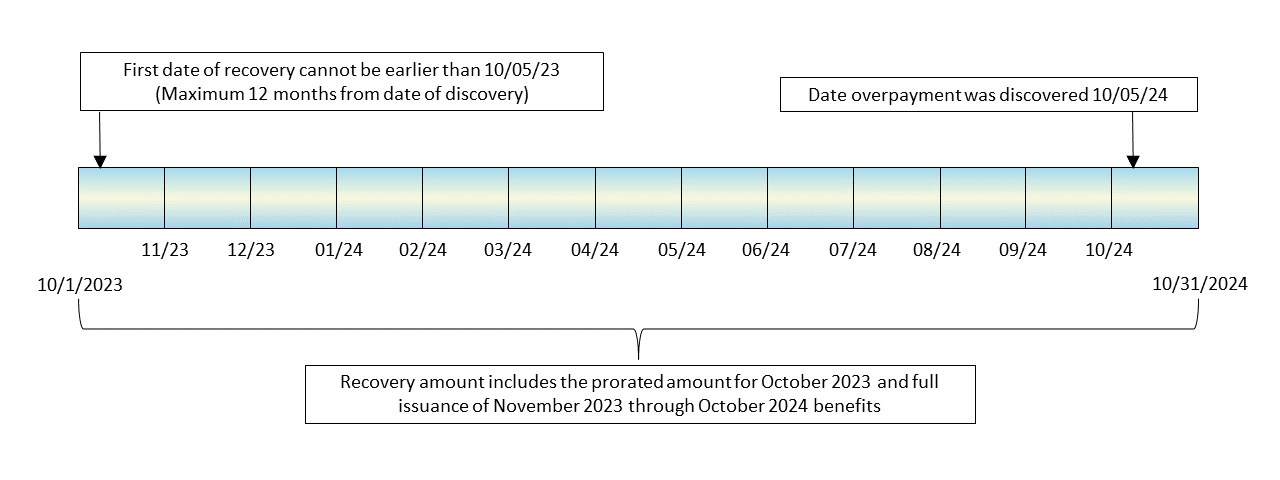

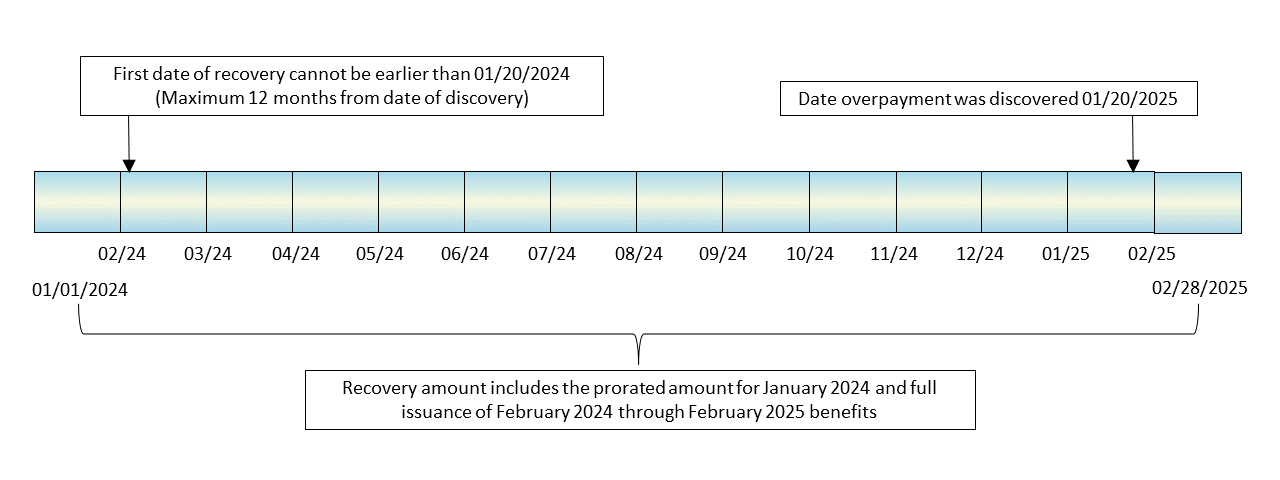

Incorrectly paid CTS benefits can only be recovered for 12 months prior to the date of discovery of the incorrect payment. Agencies administering CTS must ensure that recovery of incorrectly paid CTS benefits extends no more than 12 months back from the date of discovery.

Date of discovery means the actual date, not the month of discovery. Unless the discovery is made on the first of the month, the overpayment amount for the first month will need to be prorated. To prorate the overpayment amount, divide the monthly payment amount by the number of days in that month and round down to the nearest dollar. Then multiply the result by the number of days subject to recovery in that month.

| Example 1: | A worker discovers on October 5, 2024, that an overpayment of CTS benefit occurred because the child, for whom the benefit was being paid, was not living in the home since August 1, 2023. CTS closes effective November 1, 2024. Since recovery can only extend back 12 months from date of discovery, only the benefits paid from October 5, 2023, to October 31, 2024, can be recovered. Benefits paid August 1, 2023, to October 4, 2023, are not recoverable. If the CTS payment was $275, the overpayment amount is calculated as follows: October 2023 prorated amount is $239 ($275 ÷ 31 days x 27 days = $239) because the error was discovered on the 5th of the month. November 2023 – October 2024 = $3,300 ($275 x 12 months) Total overpayment is $3,539 ($239 + $3,300). |

| Example 2: | The worker discovers on January 20, 2025, that the recipient’s assets exceeded program limits starting January 1, 2023. CTS closes effective February 28, 2025, following adverse action notice. Since the discovery date is January 20, 2025, the overpayment can only extend back to January 20, 2024. Benefits paid January 1, 2023, to January 19, 2024, are not recoverable. If the CTS payment was $250, the overpayment is calculated as follows: January 2024 prorated amount is $106 ($275 ÷ 31 days x 12 days = $106) because the error was discovered on the 20th of the month. February 2024 – February 2025 = $3,575 ($275 x 13 months) Total overpayment $3,681 ($106 + $3,575). |

CTS overpayments that occur because the worker cannot give proper (timely) notice and close the case by the end of the current month are also recoverable.

| Example 3: | On December 21, 2006, the worker learns that a child moved out of the home on December 19, 2006, and the case is no longer eligible for CTS. The worker enters the new information into CARES but the CTS eligibility does not end until January 31, 2007. The benefits paid in January are subject to recovery since the parent was not eligible for them, but they continued until adverse action notice could be provided. |

Voluntary repayments of CTS overpayments may be addressed to:

DHS

ATTN: State SSI Program

P.O. Box 6680

Madison, WI 53716-0680

This page last updated in Release Number: 23-03

Release Date: 12/18/2023

Effective Date: 12/18/2023